What makes Freya different?

Saving money can be slow, frustrating and uninspiring. Most people wonder whether saving is worth it at all. Accruing a store of wealth is not fun. As a matter of fact, it takes discipline - and some investment knowledge. The good news is that investing is not just for rich and financially educated people - not if you've got the Freya app!

We developed the Freya application to minimize the complexity of saving money. It's designed to make investing easier and more accessible to anyone who wants to become an investor. It doesn't matter if you are new to investing or an experienced campaigner, Freya does a lot of the groundwork for you.

How Freya makes investing easier

You don't have to be a financial expert or have the mathematical genius of Einstein. Freya is the easiest application to invest with because it helps you save money and finds investments that show the most promise. Choose the investment style you like and we will invest for you! Our investors are prudent and experienced professionals and will help you build a diverse and well-balanced investment portfolio.

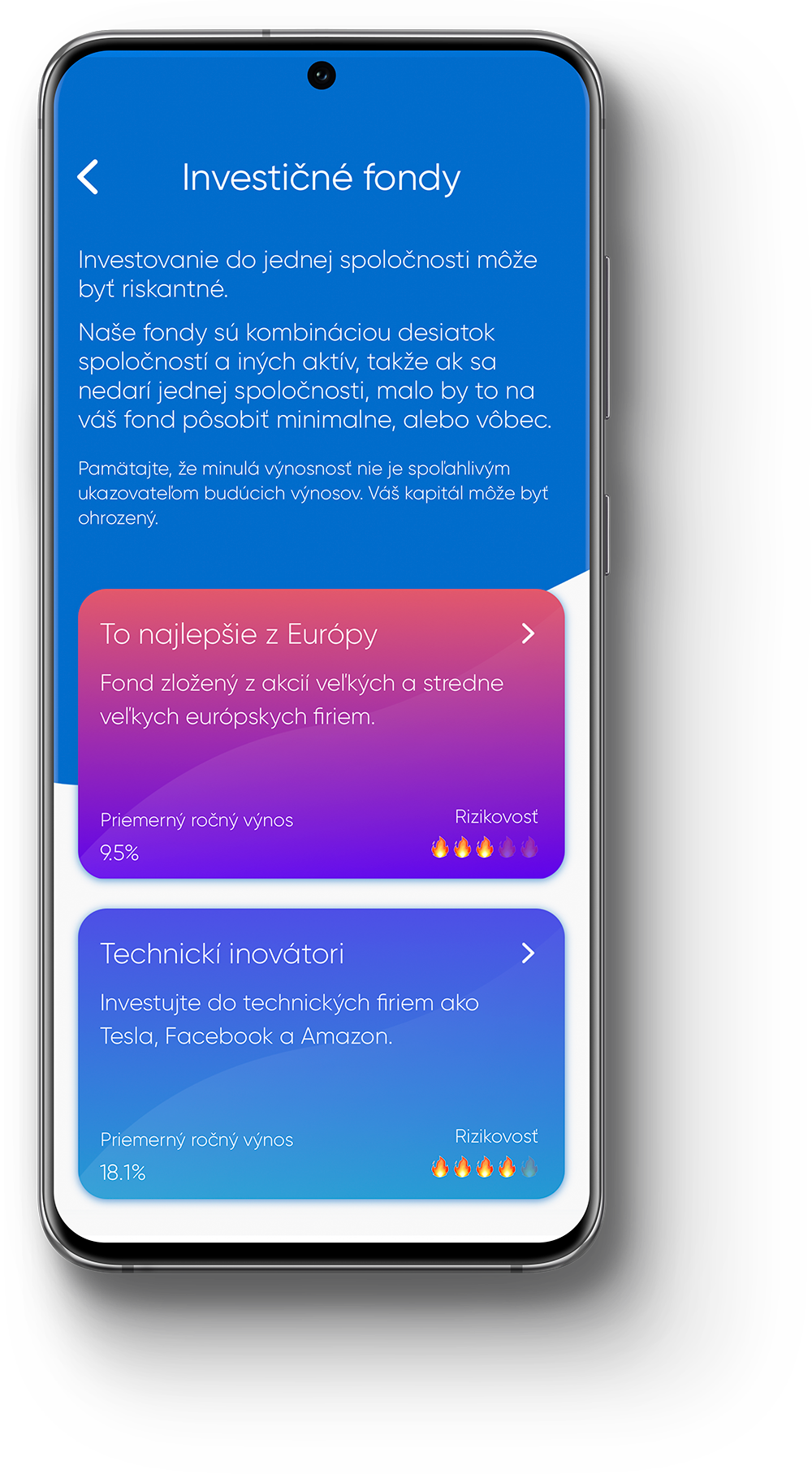

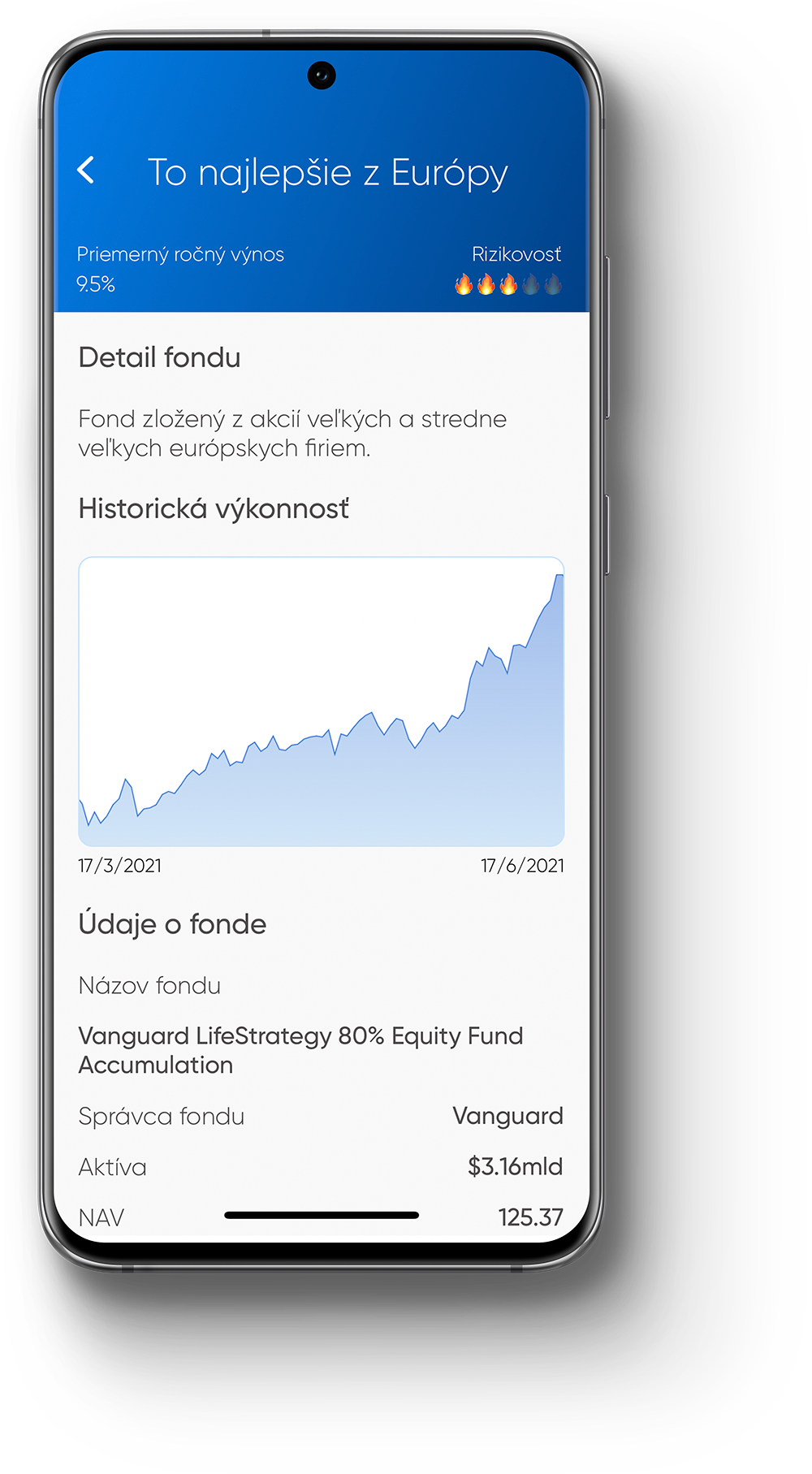

Choose a portfolio

Choose from a wide range of investment portfolios.

Choose the level of risk

Decide which portfolio suits your risk preferences.

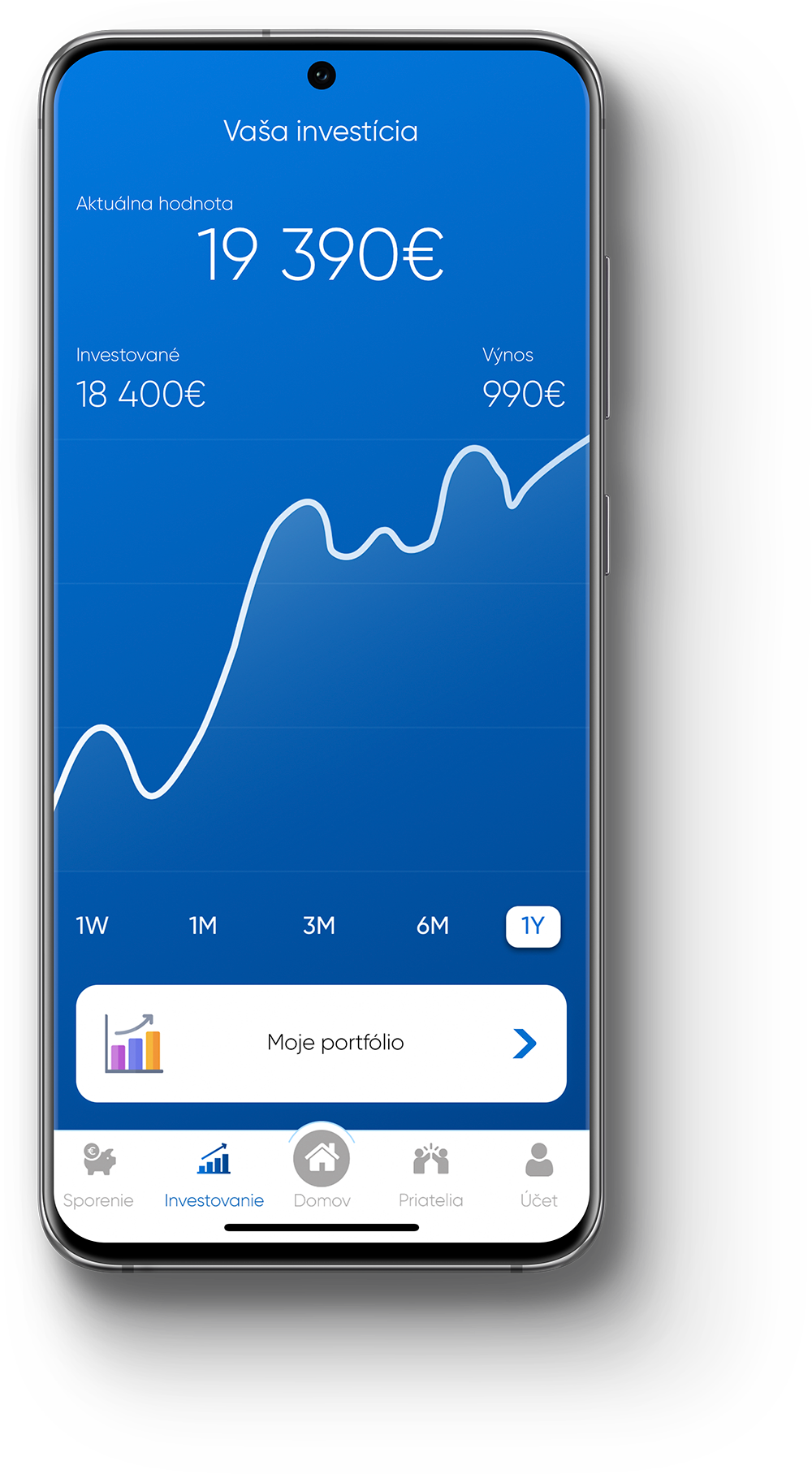

Watch how your invetsments move

Get a complete revenue report with a few clicks.

How Freya makes saving easier

Freya is a micro-saving and micro-investment application. This means that you can build a store of wealth by saving small amounts of money each day. Take responsibility for your finances and create the future you want step by step.

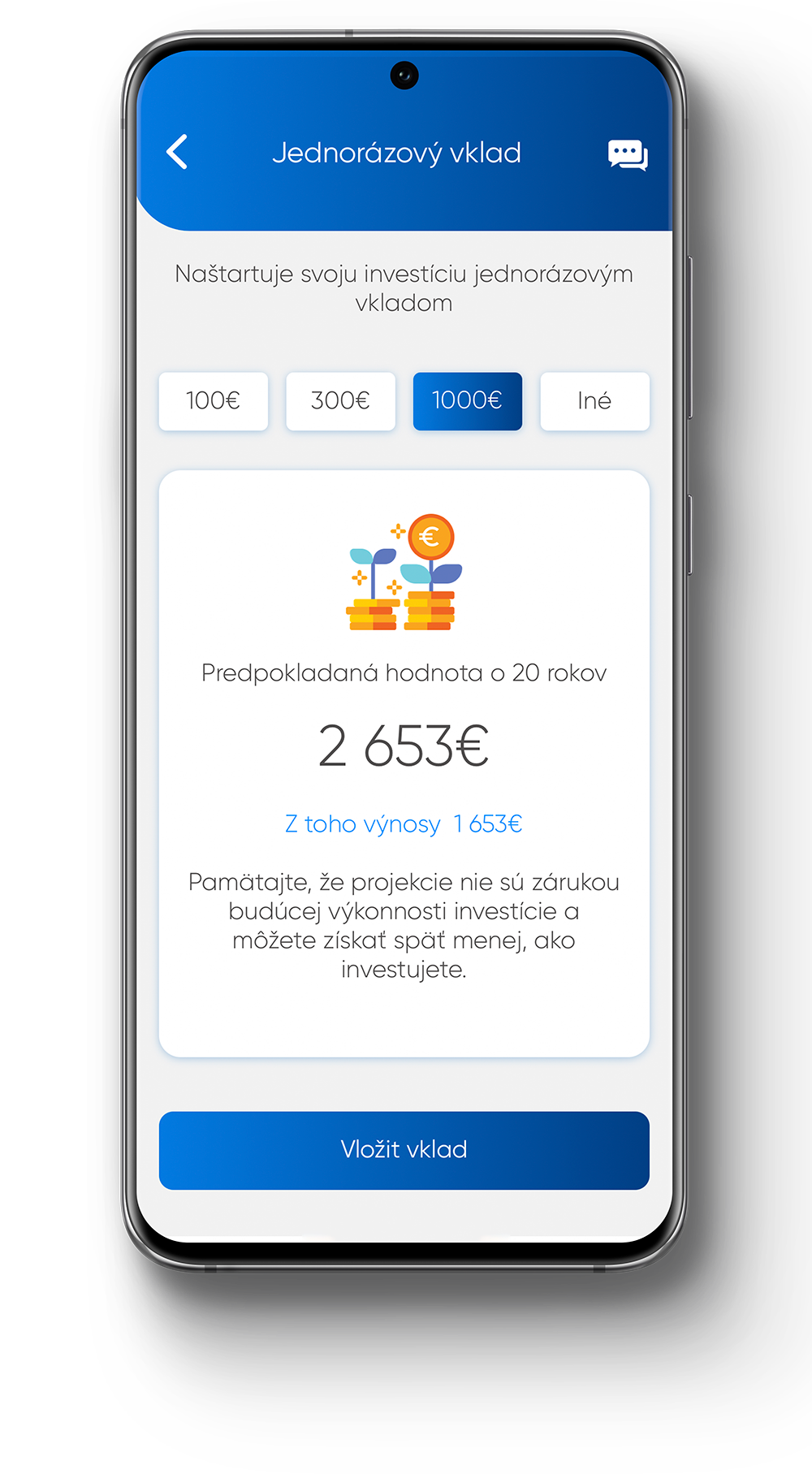

Initial deposit

Start your investment journey with an initial deposit.

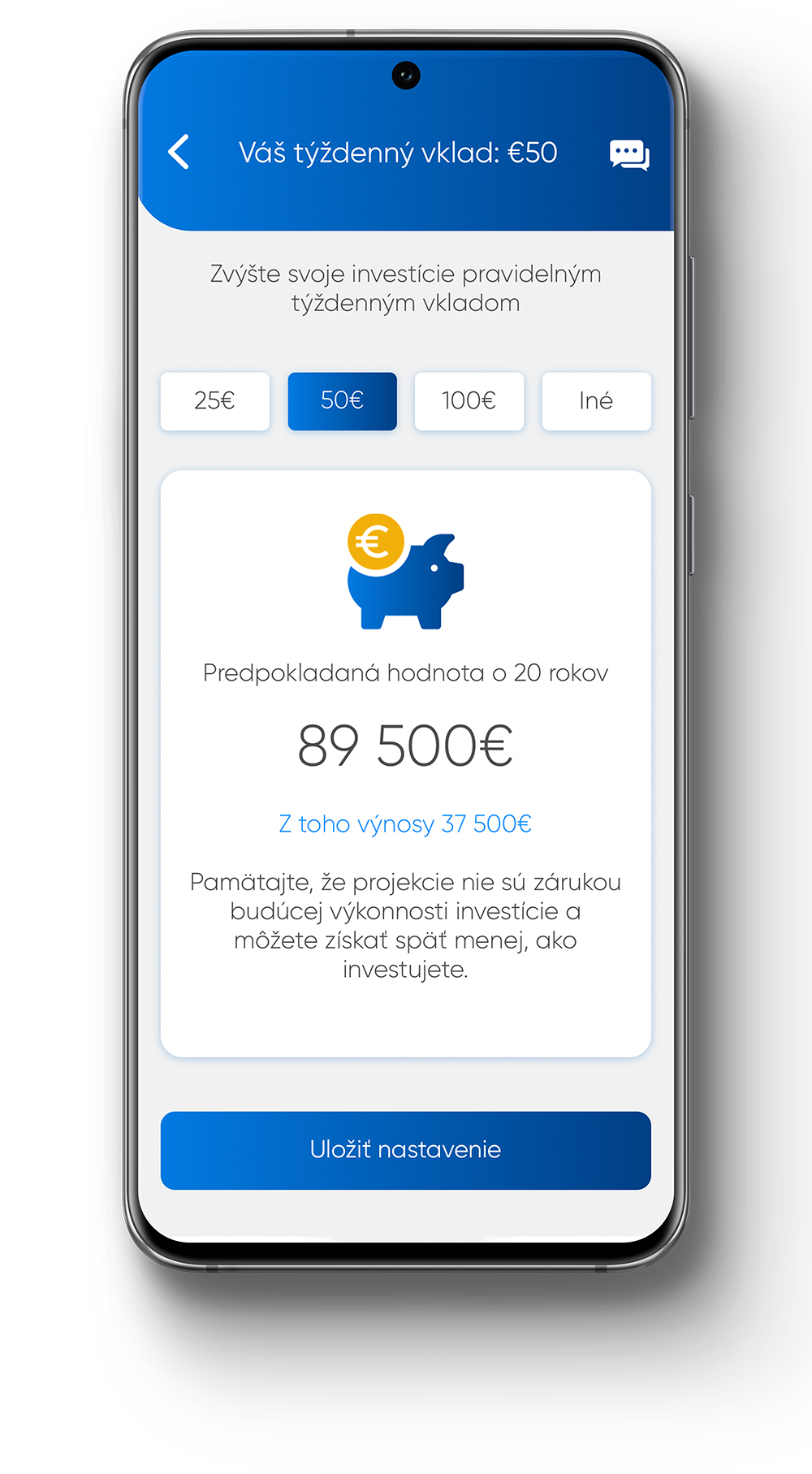

Regular deposit

Support your investments with a regular weekly deposit.

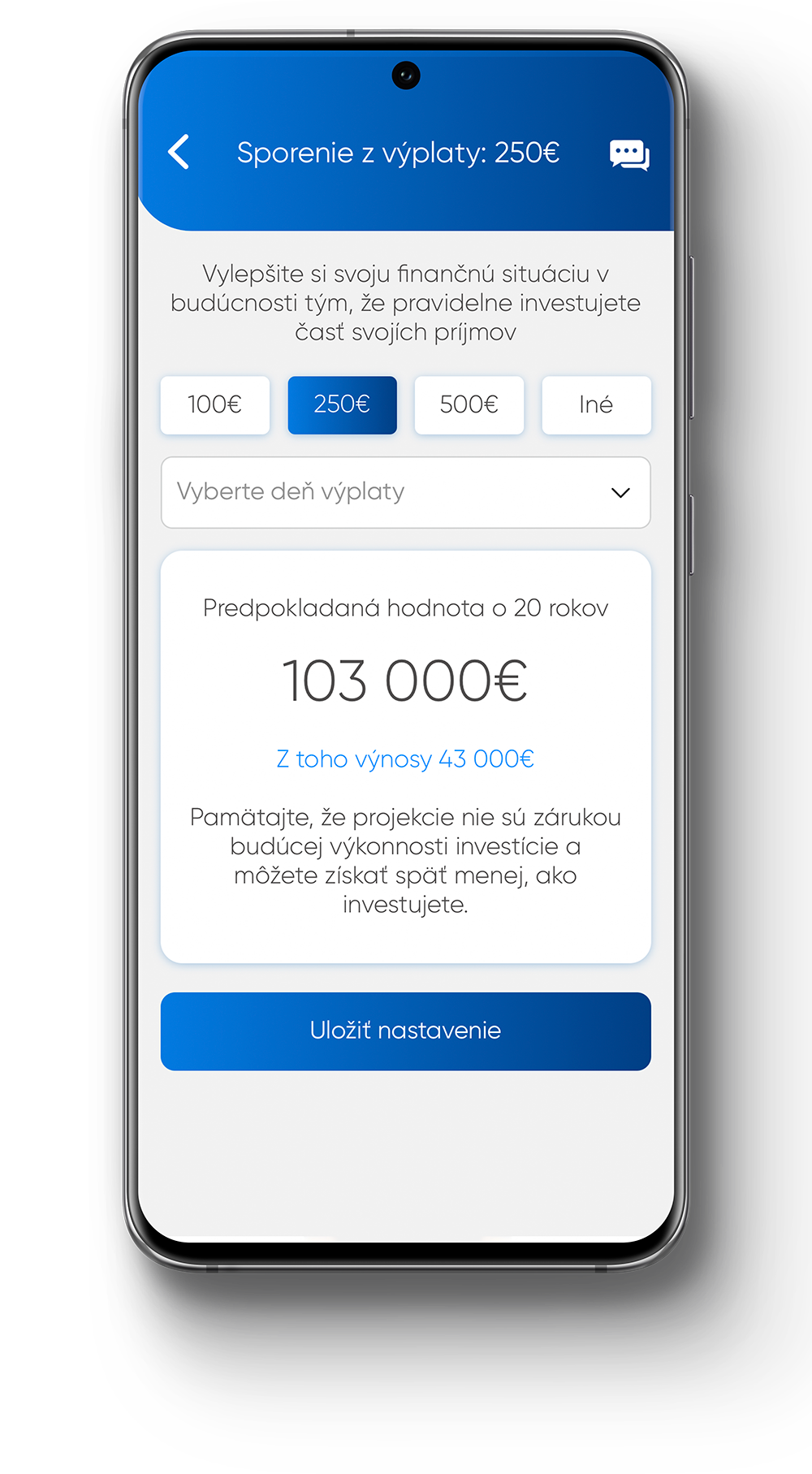

Reward yourself first on payday

On the payday set aside a certain amount each month and reward yourself first.

Which investment account will you choose?

By saving a little money a lot of the time, you will build a bigger bank balance. Choose the account that suits you and make more money that you will spend more wisely.

Basic account

€ 1 per month

Are you a first time investor? Invest small amounts in regular deposits and your money will automatically appreciate in your investment account.

Invest

Saving and investment account

-

Fee 0.88% p.a.

-

The ideal approach for those who want to start investing effortlessly

-

Possibility to choose from 3 portfolios

-

Invest from 1 €

-

No entry and exit fee

Benefits

If you want more benefits, you can switch to a more convenient account.

Premium account

€ 3 per month

Get a full range of investment and banking services, including retirement investment savings and premium financial advice.

Invest

Saving and investment account

-

Fee of 0.55% p.a.

-

Great choice for those who want to enjoy all the benefits of investing

-

Possibility to choose from 6 portfolios

-

Investing from € 3 per month

-

No entry and exit fee

Other benefits

-

First month is for FREE

-

Diversified portfolios

-

Sharing success with Musk

Family account

€ 3 per month

Create investment saving accounts for children, take control of personal investments and savings and gain access to exclusive offers and content.

Invest

Saving and investment account

-

Fee 0.88% p.a.

-

The optimal solution for investors with long-term goals

-

Possibility to choose from 10 portfolios

-

Invest from € 3 per month

-

No entry and exit fee

Ďalšie výhody

-

First month is for FREE

-

Each child has its own sub-account

-

Unlimited number of sub-accounts

Round up

Each time you pay by card, we round the purchase amount up and deposit the remaining cents into your account. • On average, you can save up to € x a day.

Deferred percentage

We will transfer a fixed percentage of each income you receive in your account. • Users save up to xy € per month.

Automatic saving

Set aside daily, weekly or monthly the amount that you will not miss in your budget. • This saves an average of € x a month.

Big challenge

Get out of your comfort zone and meet more demanding challenges. Eliminate bad spending habits and adopt new habits that you will save day by day. • You are on your way to save more than xy € per day.